How will Social Media Stocks Trade Post-Earnings (FB, LNKD, TWTR)?

August 3, 2015"In a world that’s changing really quickly, the only strategy that is guaranteed to fail is not taking risks."

-Mark Zuckerberg

To say that the big social media stocks did not fare well last week after reporting earnings is an understatement. Facebook was down a comparatively mild 4%, but both Twitter and LinkedIn were down a whopping 20% over just a few days. How are they likely to trade from here?

We looked at the 1 month trading patterns for all three, and searched for similar patterns historically within Internet Content & Information stocks to get a gauge on how they react to similar environments. Further, we included the earnings events, meaning we only included historical matches that had earnings announcements with the same proximity to each of these stocks announcements from last week.

Although they all got hit on earnings last week, the trading patterns going into the earnings release are all quite different and contain valuable information about the range of the moves after the announcement.

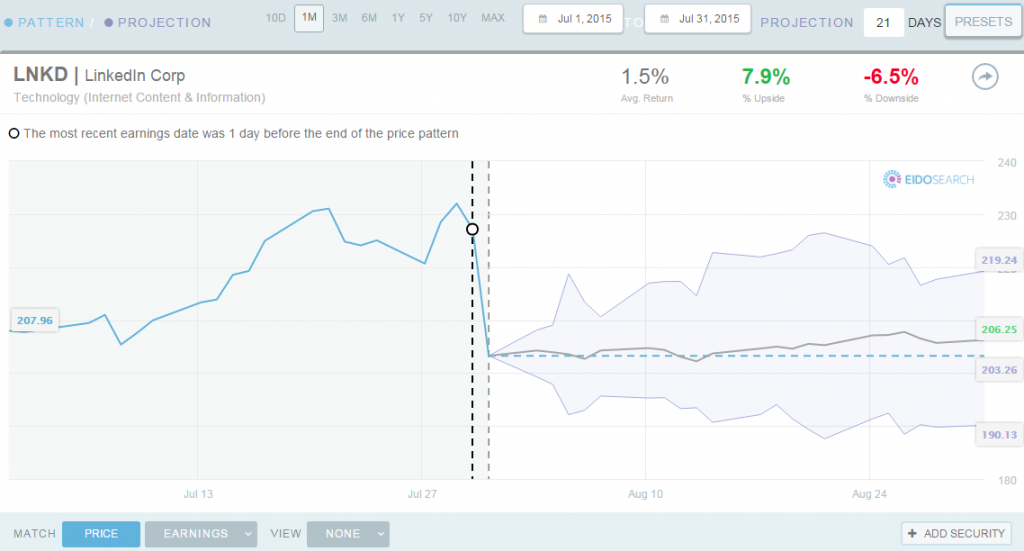

1 month Projection for LinkedIn

We found 30 similar matches over the past 10 years. The stock is up 60% of the time an average of 1.5% in the next 1 month.

Most similar analog for LinkedIn today is LendingClub from Q1:

1 month Projection for Twitter

We found 28 similar matches over the past 10 years. The stock is up only 39.3% of the time an average of -1.2% in the next 1 month.

Most similar analog for Twitter today are Travelzoo and Yahoo! From 2007 and 2006 respectively:

1 month Projection for Facebook

We found 55 similar matches over the past 10 years. The stock is up only 45.5% of the time an average of -0.6% in the next 1 month.

Most similar analog for Facebook today is Zynga from 2012:

Summary

Facebook traded up into their earnings release and had a mild pull back last week. Peers historically are up 45.5% of the time and the next 1 month projection is pretty flat. NEUTRAL

LinkedIn also traded up into the print, but had a huge pull back last week. Peers historically are up 60% of the time an average of 1.5%. MORE POSITIVE

Twitter traded flat into the print and had a huge pull back last week. Peers historically are up 39.3% of the time an average of -1.25%. MORE NEGATIVE

Have a great week!

![LNKD closest match[1]](http://www.eidosearch.com/wp-content/uploads/2015/08/LNKD-closest-match1.png)