Crude’s Rebound Short Lived

August 31, 2015"And they're takin' their sweet time bringin' the oil back, of course, and maybe even took the liberty of hiring an alcoholic skipper who likes to drink martinis and play slalom with the icebergs, and it ain't too long 'til he hits one, spills the oil and kills all the sea life in the North Atlantic"

-Good Will Hunting

Early last week with panic setting into the stock market, we provided statistics in our Monday Market Call showing that there was 85% probability the stock market would drop less than 1.2% last week. We distributed the call with the market already down 4% last Monday morning. Are we just plain stupid?

Nope. We had the confidence of probabilities on our side. Understanding, through statistics, how the market reacts to these similar times historically provided us with an objective view on how the market was likely to respond once again today. The average or typical outcome we communicated last Monday for the SPX was a rebound of .91%. The market ended the week up .80%.

This highlights the power of using probabilities to your advantage. The VIX provides a fear gauge for how participants feel right now, but does little more than tell us how much we should be freaked out ourselves. EidoSearch provides a gauge on how market participants have reacted to these similar environments historically to provide forward probabilities that can be used for risk management, positioning and trade opportunities.

85% Probability Crude will have less than a 2.2% gain this week with almost 4x the downside to upside

This week we’re taking a look at Crude Oil. Crude jumped 17% in the last two days on an unexpected Q2 GDP revision, a stock market rebound and some disruption with refineries and pipelines. How unique is this type of move?

The EidoSearch engine searched for the current 1 month price trend historically, which captures the steadily declining price through the end of last week and then the steep jump over the past couple of days. We found 62 similar instances over the past 40 years to provide us with our objective gauge for this week.

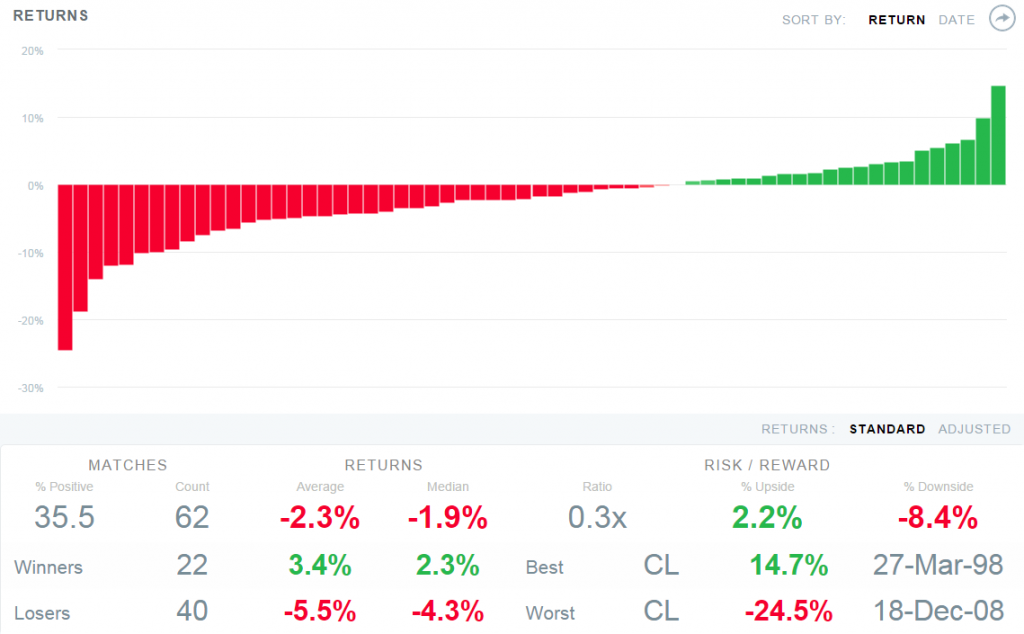

The following projection shows the statistics for the average outcome of the 62 similar matches historically, and for the range of probable outcomes from a 2.2% gain to a -8.4% drop. There’s 70% probability Crude will be within that range by weeks end, and the typical or average return in the next one week is a drop of -2.3%.

Crude is down 64.5% of the time in the next 1 week

The table below plots the 1 week forward returns of all similar historical matches of the current 1 month price trend in Crude. You can see overall that Crude is down almost two thirds of the time. On the tails, there are 6 instances that run up over 5% in the next week, while there are 16 that drop more than 5%.

The biggest continued drop was -24.5% from December 11–18 of, you guessed it, 2008. The biggest jump in the next one week was 14.7% from March 20-27 in 1998.

Have a great week!