Good Entry Point for Wal-Mart (WMT)?

By EidoSearch"Every Exit is an Entry somewhere else"

-Tom Stoppard

Wal-Mart’s stock price has taken a beating over the past few months. After hitting an all-time high of $90.47 on January 8th, the stock is now down -14% as of Friday’s close while the market is up a little bit over the same time. Is this typically a good time to buy or a good time to get out?

At EidoSearch, we analyze patterns in data through our patented “Data-Based Intelligence” technology. We simply match patterns from the vast amount of Big Financial Data historically (a billion a day actually), to find like examples from history and to capture the markets response across all different possible market conditions. This allows us to provide a range of return probabilities that we’ve back-tested exhaustively.

The majority of investment decisions are based on fundamentals. The majority of our clients are fundamentally oriented, and where our statistics typically add a lot of value is at decision points. If a PM likes the fundamentals behind Wal-Mart, has a position, and is wondering if this is a good time to build the position further on the dip, we provide a gauge to strengthen the profitability around that “timing” decision.

So, without getting into the fundamentals on why Wal-Mart has been getting crushed or why it may or may not be poised for a rebound, we’ll let the statistics do the talking. Whether or not you believe in data analysis, pattern analysis or statistics and probabilities, the scenarios below are pretty compelling.

Scenario #1: Looking at the current 3 month price trend in Wal-Mart’s trading history

Here’s a chart of the 1 month forward returns for the 52 mathematically similar instances of the current 3 month price trend we found in WMT’s trading history. There is only one example, from May of 1973, where the stock runs down more than -7% in the next month. There are 20 historical examples of the next 1 month’s return that are up 7% or more. The stock is up 75% of the time in the next month.

The projection below shows the average return of all 52 examples in Wal-Mart’s history. The stock is up an average of 7.1% in the next 1 month. You can also see a much different skew in EidoSearch’s projected return distributions than what the market is pricing in via Options (implied vol overlay in orange below).

Scenario #2: Looking at Wal-Mart’s current 3 month price trend in Lg Cap Department Stores historically

In addition to looking just at Wal-Mart’s history for comps, we also looked at peer companies to provide additional analysis on the range of returns after this time of pattern historically.

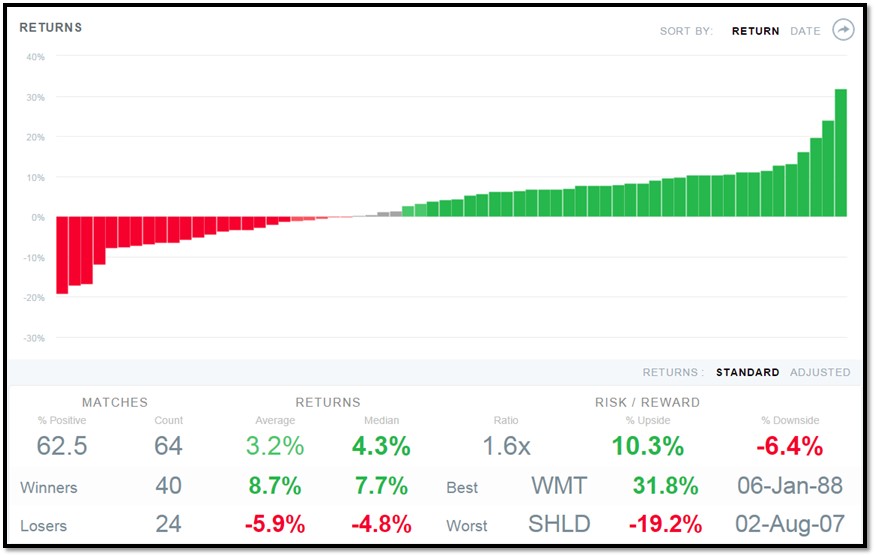

Here’s a chart of the 1 month forward returns of each of the 64 mathematically similar instances of WMT in the peer group historically. The three negative tail instances are from Sears and J.C. Penney (twice) from 2007. The stock is up 62.5% of the time in the next month in this analysis.

The average return looking at the peer group for similar instances from history is a 3.2% in the next one month. You can also see where the EidoSearch forecasted return distributions are similar to the markets expectations for volatility to the downside (implied vol overlay in orange). However, based on the actual return distributions of this pattern historically, there is much greater projected upside than the market is pricing.

Scenario 3: Looking at a longer 6 month price trend in Wal-Mart’s history

By looking at a 6 month pattern, you’re able to capture the stock’s strong run-up in Q4 as well as the current big drop. We found 11 similar instances in Wal-Mart’s history, and only one time is the stock down in the next 3 months (Spring of 2000 Market bubble).

Average return of the 11 similar matches in Wal-Mart’s history is 11.1% in the next 3 months. You can also see in the chart below how the market is currently under appreciating the upside range in volatility (implied vol overlay in orange in the chart below).

Have a great week!