Molson Coors is Oversold According to the Stats

July 6, 2015"Cause, baby, you’re a firework. C’mon show ‘em what you’re worth."

-Katy Perry

Other than being a bit embarrassed about this week’s quote, we try to stay unemotional when penning our Weekly Market Call and let the probabilities do the talking when it comes to valuations. We decided to look for an outlier this week in over 3,500 US Equities, one where the reaction to the current pattern historically has been overwhelmingly consistent.

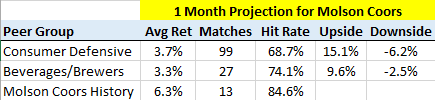

Molson Coors (A Shares) has had a rough 2015. Shares are down about 30% so far this year in the face of weakening demand and sales in key markets, while the Morningstar Consumer Defensive Index is up about 1% for the year. We analyzed their current price pattern in three ways, looking for similar matches historically within the Sector (Consumer Defensive), Industry (Beverages/Brewers) and in their own history.

The results in all three scenarios favor a rebound in the next 1 month.

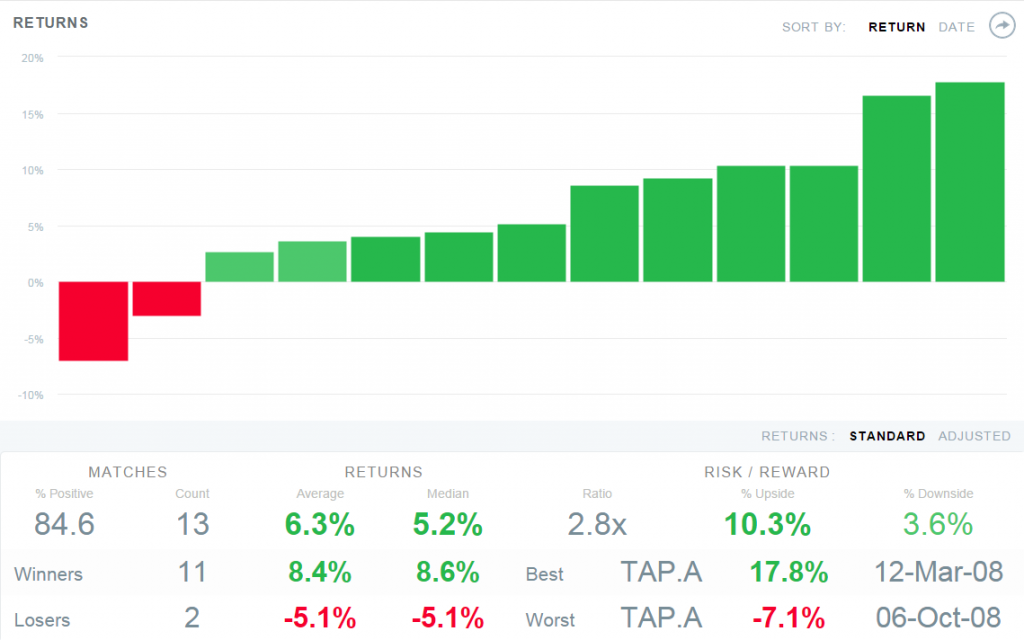

Projection using just Molson Coors own trading history

· Only two down instances of the 13 statistically similar matches are from Fall 2008 and Summer of 2005

· The avg. relative return to the SPX of these 13 instances is a robust 5.5%

Have a great week!