Precedence for a Further Drop in Gold

July 20, 2015"The desire of gold is not for gold. It is for the means of freedom and benefit. "

-Ralph Waldo Emerson

Gold prices continue to decline, and the sell-off is accelerating. China appears to be slowing down its purchasing and there was a big sell off today leading to a sharp decline and hitting price levels not seen in 5 years. This on top of the fact that the dollar is strengthening and the Fed is expected to start raising rates by end of year, and you have an environment where pressure on prices seems destined to persist.

How much further could prices drop? Are we nearing a bottom?

EidoSearch looked at the 4 yr, 3 yr, 2 yr and 1 yr price trends in Gold (in data going back to the early 70’s), to find similar environments with these patterns historically and get statistics on the outcomes.

1 year price trend analysis

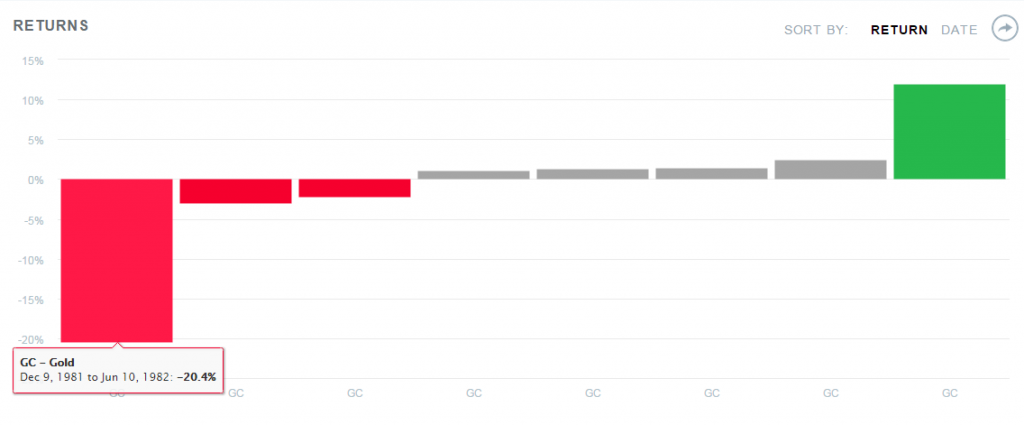

· 6 similar historical matches

· Oldest being from ’81-‘82

· Average return in next 6 months is 8.1%

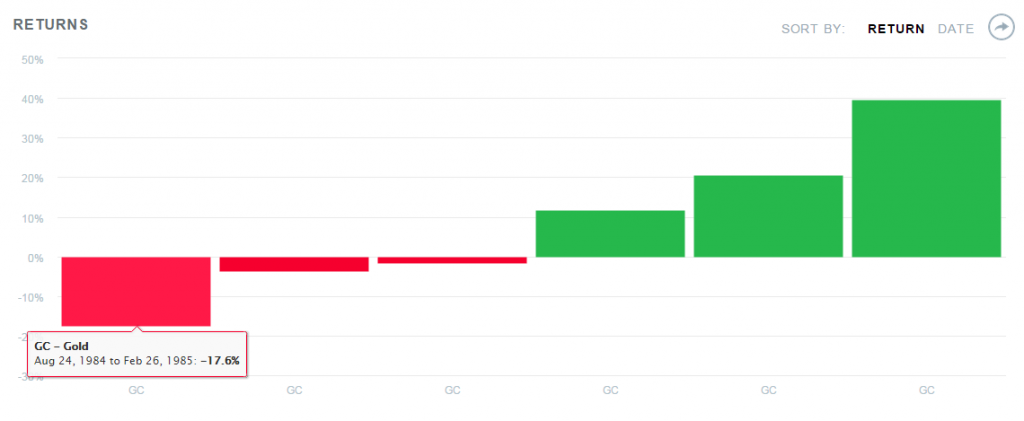

· Only double digit decline is from ’84-‘85

· 8 similar historical matches

· Oldest being from ’81-‘82

· Average return in next 6 months is -1.0%

· Only double digit decline is from ’81-‘82

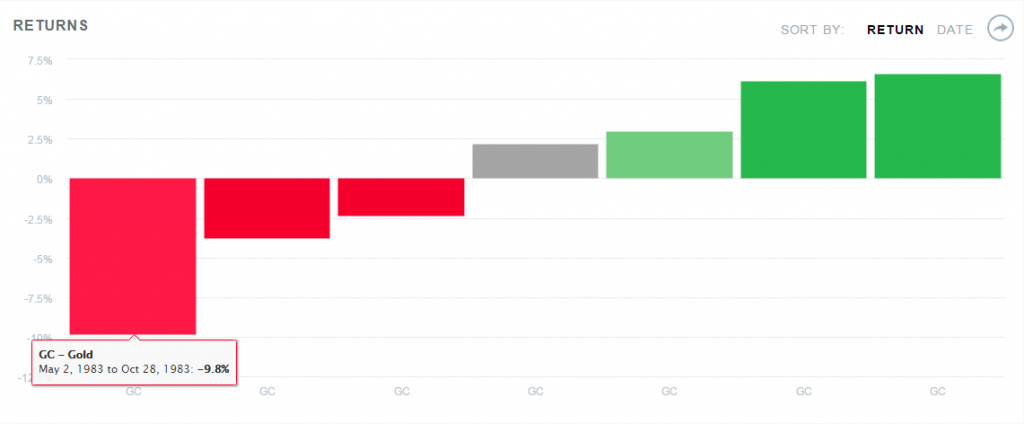

· 7 similar historical matches

· Oldest being from ’82-‘83

· Average return in next 6 months is 0.3%

· Biggest decline is from 1983

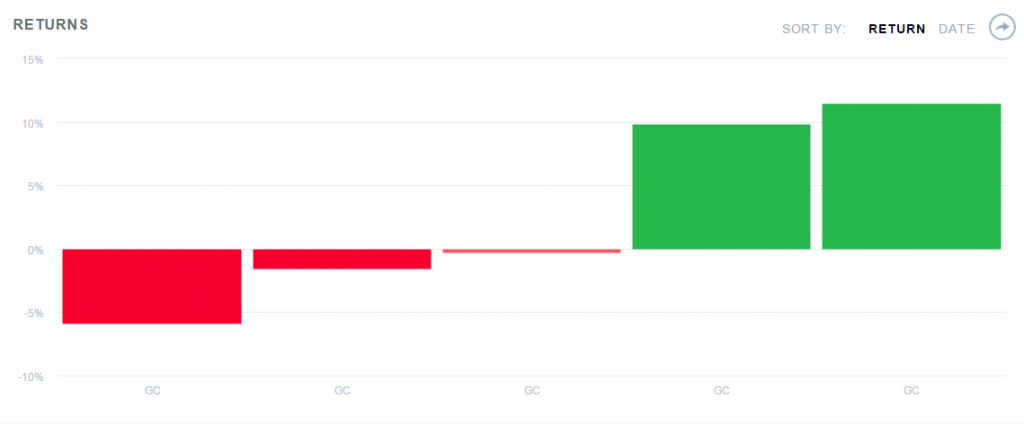

· 5 similar historical matches

· Oldest being from ’83-‘84

· Average return in next 6 months is 2.7%

Summary

Over 40 years of history, the only precedent for a further drop of more than 10% in the next 6 months, looking across each of the 4 price trend lengths, are a few times in the early 1980’s. There are no other similar periods where Gold continues down any more than 5% from here.

Have a great week!